Life Insurance with Health Conditions in Idaho

Health issues don’t automatically disqualify you from getting life insurance — but they do change the game. A lot of people in Idaho get discouraged after one decline or a super-high quote and assume they’re out of options.

I specialize in impaired-risk life insurance underwriting, which is a fancy way of saying: I spend a lot of time helping people with health conditions find realistic, affordable coverage. If you live in Boise or anywhere in Idaho and you’ve got blood pressure, diabetes, heart, weight, or cancer history concerns, this page is for you.

How Health Conditions Affect Life Insurance Approval

Life insurance companies all look at the same big picture:

Your age

Your health history and current diagnoses

Your medications

Your build (height and weight)

Tobacco use

Family history and lifestyle factors

But every company weighs those factors differently. One carrier might be very friendly toward well-controlled blood pressure but tough on diabetes. Another might be flexible on build but strict on heart history.

That’s why working with an independent agent who understands impaired-risk cases matters more than just running another generic online quote.

My Process for Clients with Health Conditions

I rarely recommend guaranteed issue as a first choice — it’s a tool for specific situations, not a default plan.

We talk honestly about your health.

We’ll review your diagnoses, medications, recent lab work if you have it, and any past life insurance applications or declines.

I match your profile to the right carriers.

Different insurers have different “sweet spots.” I look for companies that are more forgiving around your particular risk (blood pressure, diabetes, cardiac history, etc.).

We decide what type of coverage makes sense.

Depending on your situation, that might be traditional term or whole life, simplified issue, final expense, or guaranteed issue.

We keep expectations realistic.

I’ll be upfront about what looks doable and where it might be a stretch, so you’re not surprised later

We apply in the simplest way possible.

Many companies now offer electronic applications and no-exam options. In some cases an exam may still be the best path to better rates.

The Main Types of Life Insurance

Below are some of the most common health situations I see with Idaho clients, and how we generally approach them. Everyone’s situation is unique, but this gives you a sense of what may be possible.

High Blood Pressure (Hypertension)

If your blood pressure is treated and reasonably controlled, many companies will still consider you for traditional term or whole life coverage.

Key points:

Medication is not an automatic decline.

Very high, uncontrolled readings can mean higher premiums or a postpone decision.

The longer your blood pressure has been stable, the better.

I have carriers that are very familiar with hypertension cases. If you’re in Idaho and take blood pressure meds, call or text 425-761-0555 and we’ll see what’s realistic.

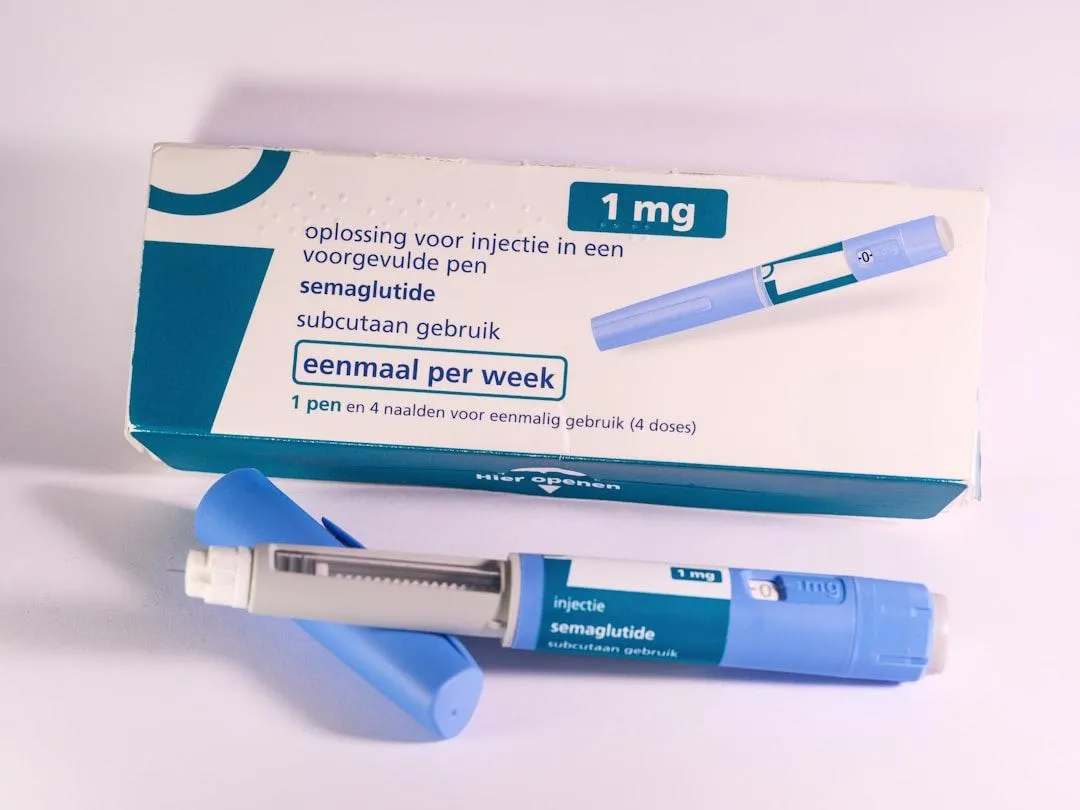

Diabetes (Type 2 & Some Type 1)

Diabetes can absolutely be insured, especially when it’s monitored and managed.

Key points:

Companies look at A1C levels, medications (including insulin), and any complications.

Good control, regular checkups, and no major complications can still qualify for solid coverage.

More serious or poorly controlled cases may be better suited for simplified issue or final expense plans.

Heart History (Heart Attack, Stents, Bypass)

Heart issues are more complex, but not always a hard “no.”

Key points:

Carriers will want to know the type of event, dates, and follow-up care.

A clean period of time after the event with good follow-up can help.

Sometimes we structure coverage in smaller amounts or use a graded benefit or final expense policy.

Cancer History

Many people who’ve had cancer assume they’re uninsurable. It’s not always true.

Key points:

Factors: type of cancer, stage, treatment type, length of time since remission, and follow-up.

Some cancers have shorter “waiting periods” before traditional coverage is available again; others are longer.

In the meantime, guaranteed issue or final expense policies can provide some protection.

High BMI/Weight Concerns

Build charts can be brutal, but there are carriers with more flexible guidelines.

Key points:

We look at your height, weight, and any related conditions (sleep apnea, blood pressure, diabetes).

Some companies are more forgiving, especially if you’re otherwise stable and active.

In some cases, we may look at simplified issue, graded benefits, or guaranteed issue to avoid outright declines.

Tobacco Use

Smoking or other tobacco use will increase premiums, but it doesn’t mean you can’t get coverage.

Key points:

Different products for cigarettes, cigars, chew, vaping, etc.

Some carriers are more flexible with occasional cigar use.

If you’ve quit recently, there are timelines for when you may qualify for “non-tobacco” rates.

When Guaranteed Issue May Make Sense

Guaranteed issue life insurance is designed for people with serious health challenges or multiple past declines.

No medical exam

No health questions in many cases

Approval based on age and residency

Usually has a waiting period (often 2–3 years) for natural causes of death

Benefit amounts are smaller, often used for final expenses

I don’t recommend guaranteed issue for everyone — it’s usually a last-resort or special-situation tool. But for some Idaho clients, especially seniors with serious health issues, it’s the one way to guarantee a small amount of protection is in place.

What If You’ve Been Declined Before?

If you’ve already been declined, don’t panic and don’t give up. It just means we need to be more strategic.

I’ll review what happened on the previous application.

We’ll talk about whether anything has changed with your health.

I’ll identify carriers that may be more friendly to your specific risk profile.

In some cases, we’ll pivot to simplified issue, final expense, or guaranteed issue.

The biggest mistake is doing nothing and leaving your family unprotected because one company said no.

What This Looks Like for You (Realistic Expectations)

Set expectations clearly:

Your premium may be higher than a perfectly healthy person your age — that’s normal.

The amount of coverage you qualify for might be smaller than you hoped, especially at older ages or with multiple conditions.

Even a modest policy can make a huge difference for your family.

Because I’m based in the Boise / Treasure Valley area, I’m familiar with the carriers that consistently show up here and how they tend to treat certain health profiles.

Ready to Talk Through Your Options?

Reach out.

Call or text 425-761-0555, or email [email protected] with a quick overview of your situation.

Have your meds and diagnoses handy.

A simple list of medications, dosages, and major diagnoses goes a long way.

We’ll review realistic options.

I’ll tell you honestly what looks possible and what type of policy fits best.

You decide if it feels right.

No pressure, no “sign now or it’s gone” tactics.

If you live in Boise or anywhere in Idaho and you’ve been putting off life insurance because of your health, let’s fix that. Reach out today and we’ll see what’s actually possible — with honest expectations and a real person on your side.

No-Cost Guidance

Get free expert advice to compare plans and choose the right insurance for your family's future.

Connect with Advisor

Our experts guide you to compare plans to choose the best insurance for your family, at no cost.

Request Your Estimate

Request a personal estimate to compare plans and select the right coverage for your family.

Try for Free

Try our services free to explore key features and see how we can securely protect your future.

Useful Links

Newsletter

© Copyright Chris Antrim Insurance 2025. All rights reserved.